The global investment landscape is undergoing a profound shift as investors seek new avenues for growth and stability. In an era marked by market volatility and uncertain returns from traditional stocks and bonds, alternative assets are stepping into the spotlight.

Once considered the exclusive domain of institutions and the ultra-wealthy, these non-traditional investments are now accessible through innovative platforms and tailored products. Their growing allure lies in financial assets outside traditional categories that promise fresh opportunities and resilience.

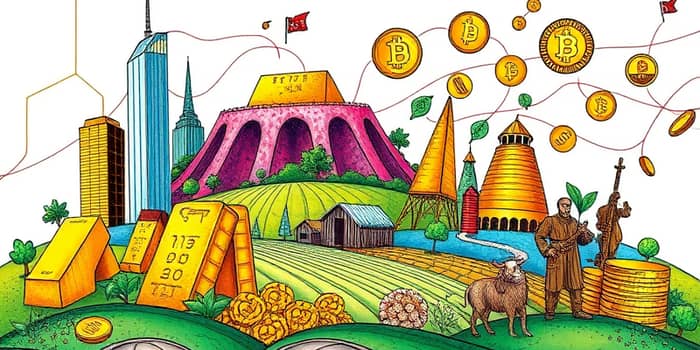

Alternative investments encompass a broad range of assets that do not fit neatly into equities, fixed income, or cash. This category includes private equity, venture capital, private debt, hedge funds, real estate, commodities, collectibles, and digital assets like cryptocurrencies.

As new fintech platforms emerge, barriers to entry are falling, opening the door for individuals to allocate a portion of their portfolios to these unique instruments. The traditional “60/40” strategy is being reimagined to include a slice of alternatives, aiming for diverse and resilient portfolio allocations.

Investors are drawn to alternatives largely because of the potential benefits they bring to a diversified portfolio:

These features contribute to lower portfolio volatility and risk, making alternatives an appealing complement to mainstream holdings.

Industry reports estimate that alternative investments comprised around $18 trillion globally in 2023, with a projected compound annual growth rate of 11–14% over the next five years. This expansion is fueled by several key trends:

First, large asset managers are targeting individual investors, introducing vehicles with reduced minimums and simplified structures. Second, digital marketplaces and peer-to-peer platforms are democratizing access for small investors into private debt, real estate crowdfunding, and other segments once reserved for institutions.

Additionally, ESG-focused alternatives—such as green infrastructure and sustainable real estate—are attracting capital from those prioritizing environmental and social impact alongside financial returns.

The integration of alternatives into Modern Portfolio Theory has yielded compelling insights. By plotting risk versus return, the inclusion of non-correlated assets shifts the efficient frontier upward and to the left, illustrating more favorable tradeoffs.

Below is a summary of major alternative categories and their typical characteristics in a diversified allocation:

This overview highlights how each alternative segment contributes distinct risk and return attributes to a portfolio. By blending them creatively, investors can tailor exposures to meet specific objectives.

While the advantages of alternative assets are compelling, investors must navigate potential pitfalls:

Balancing these risks against the potential rewards calls for informed decisions and careful monitoring.

For those ready to explore alternatives, a measured, methodical approach is key. Experts recommend starting with modest allocations—often between 10% and 20% of total portfolio value—guided by an individual’s liquidity needs, time horizon, and risk tolerance.

Consider the following roadmap:

By proceeding thoughtfully, investors can harness the distinctive strengths of alternative assets without overextending themselves.

As the global economy evolves, so too will the role of alternative investments. Continued innovation in financial technology, regulatory reforms, and shifting demographics will expand access and foster new asset classes.

Investors who embrace these opportunities with disciplined strategies may enjoy compelling risk/return profiles and a more resilient portfolio capable of weathering varied market environments.

Ultimately, the rise of alternative assets underscores a broader shift toward holistic portfolio construction—one that values both the familiar stability of stocks and bonds and the unique potential of non-traditional investments.

By integrating these diverse elements, individuals can craft a truly balanced financial future, grounded in innovation, diversity, and strength.

References